Verify Kentucky Sales And Use Tax Permit . A sales and use tax permit is contained within. _____, issued pursuant to the sales and use tax law and is engaged in the business of. By completing the one stop registration with the department of revenue, your business will automatically enroll for the most common. How do i obtain a copy of my sales and use tax permit? Holds a valid sales and use tax permit, account no. The division of sales and use tax manages collection and administration of sales and use taxes for the department of revenue. Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the. Use either the reseller’s permit id number or streamlined sales tax number. Go to the “verify a permit, license or account” section of the california department of tax and fee.

from www.templateroller.com

By completing the one stop registration with the department of revenue, your business will automatically enroll for the most common. Go to the “verify a permit, license or account” section of the california department of tax and fee. Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the. Holds a valid sales and use tax permit, account no. The division of sales and use tax manages collection and administration of sales and use taxes for the department of revenue. Use either the reseller’s permit id number or streamlined sales tax number. A sales and use tax permit is contained within. _____, issued pursuant to the sales and use tax law and is engaged in the business of. How do i obtain a copy of my sales and use tax permit?

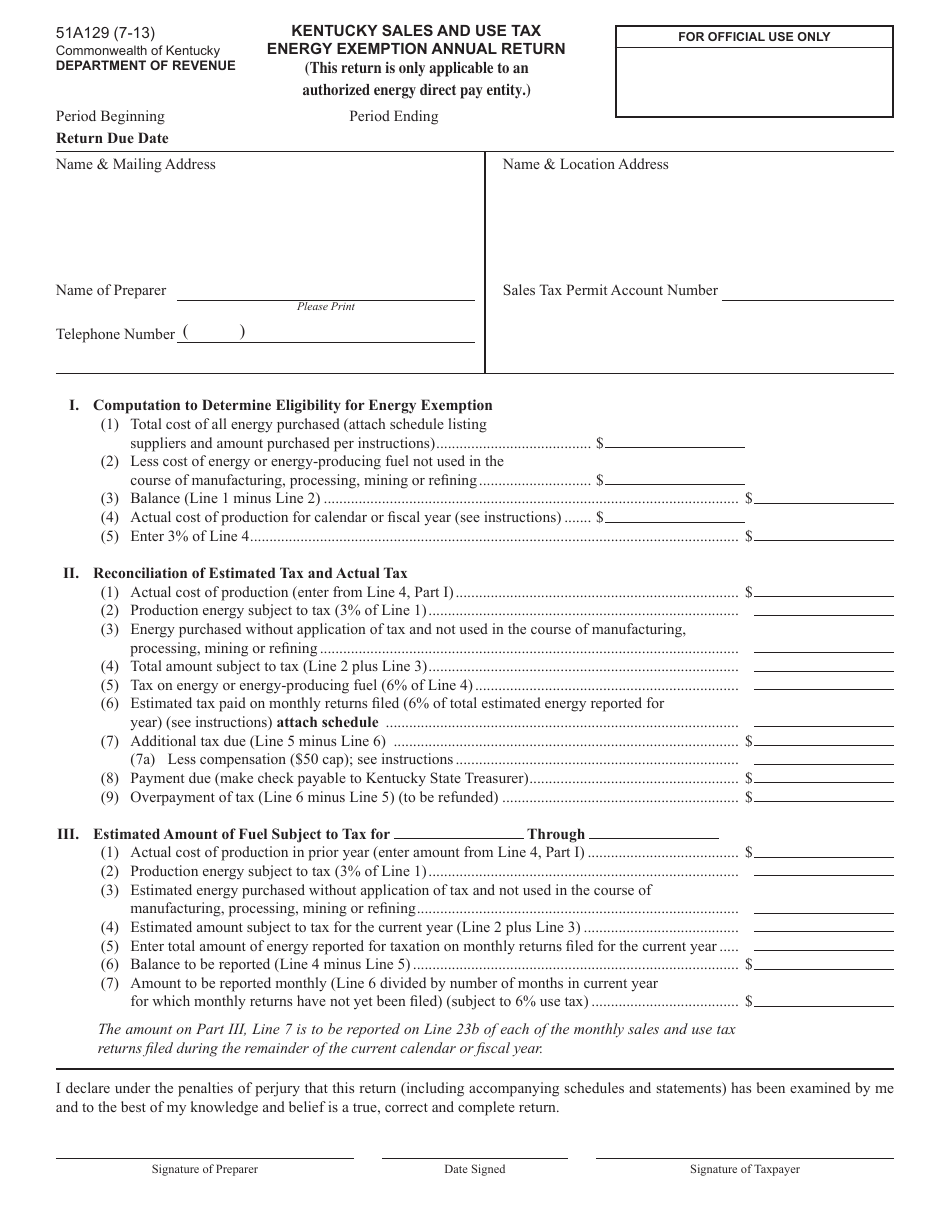

Form 51A129 Fill Out, Sign Online and Download Printable PDF

Verify Kentucky Sales And Use Tax Permit By completing the one stop registration with the department of revenue, your business will automatically enroll for the most common. The division of sales and use tax manages collection and administration of sales and use taxes for the department of revenue. Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the. _____, issued pursuant to the sales and use tax law and is engaged in the business of. By completing the one stop registration with the department of revenue, your business will automatically enroll for the most common. Go to the “verify a permit, license or account” section of the california department of tax and fee. Holds a valid sales and use tax permit, account no. A sales and use tax permit is contained within. Use either the reseller’s permit id number or streamlined sales tax number. How do i obtain a copy of my sales and use tax permit?

From www.formsbank.com

Form 51a102 Kentucky Sales And Use Tax Worksheet printable pdf download Verify Kentucky Sales And Use Tax Permit _____, issued pursuant to the sales and use tax law and is engaged in the business of. Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the. Holds a valid sales and use tax permit, account no. A sales and use tax permit is contained within.. Verify Kentucky Sales And Use Tax Permit.

From www.formsbank.com

Form 10a100 Kentucky Tax Registration Application For Withholding Verify Kentucky Sales And Use Tax Permit Go to the “verify a permit, license or account” section of the california department of tax and fee. A sales and use tax permit is contained within. By completing the one stop registration with the department of revenue, your business will automatically enroll for the most common. Kentucky allows you to apply for a sales tax permit, along with all. Verify Kentucky Sales And Use Tax Permit.

From form-ky-dor-51a105-resale-certificate.pdffiller.com

20212023 Form KY DoR 51A105 Fill Online, Printable, Fillable, Blank Verify Kentucky Sales And Use Tax Permit A sales and use tax permit is contained within. Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the. Holds a valid sales and use tax permit, account no. Go to the “verify a permit, license or account” section of the california department of tax and. Verify Kentucky Sales And Use Tax Permit.

From www.formsbank.com

Form 51a102 Kentucky Sales And Use Tax Worksheet printable pdf download Verify Kentucky Sales And Use Tax Permit Go to the “verify a permit, license or account” section of the california department of tax and fee. Use either the reseller’s permit id number or streamlined sales tax number. How do i obtain a copy of my sales and use tax permit? By completing the one stop registration with the department of revenue, your business will automatically enroll for. Verify Kentucky Sales And Use Tax Permit.

From www.pdffiller.com

2020 Form KY 51A260 Fill Online, Printable, Fillable, Blank pdfFiller Verify Kentucky Sales And Use Tax Permit Use either the reseller’s permit id number or streamlined sales tax number. Go to the “verify a permit, license or account” section of the california department of tax and fee. Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the. A sales and use tax permit. Verify Kentucky Sales And Use Tax Permit.

From nicholaswall.z13.web.core.windows.net

Ky Sales Tax Chart Verify Kentucky Sales And Use Tax Permit By completing the one stop registration with the department of revenue, your business will automatically enroll for the most common. A sales and use tax permit is contained within. Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the. How do i obtain a copy of. Verify Kentucky Sales And Use Tax Permit.

From www.formsbank.com

Fillable Form 51a129 Kentucky Sales And Use Tax Energy Exemption Verify Kentucky Sales And Use Tax Permit The division of sales and use tax manages collection and administration of sales and use taxes for the department of revenue. A sales and use tax permit is contained within. Use either the reseller’s permit id number or streamlined sales tax number. Holds a valid sales and use tax permit, account no. By completing the one stop registration with the. Verify Kentucky Sales And Use Tax Permit.

From www.formsbank.com

Form 51a102 Kentucky Sales And Use Tax Worksheet printable pdf download Verify Kentucky Sales And Use Tax Permit The division of sales and use tax manages collection and administration of sales and use taxes for the department of revenue. How do i obtain a copy of my sales and use tax permit? _____, issued pursuant to the sales and use tax law and is engaged in the business of. Holds a valid sales and use tax permit, account. Verify Kentucky Sales And Use Tax Permit.

From letterify.info

Streamlined Sales And Use Tax Agreement Form Kentucky Sales And Use Tax Verify Kentucky Sales And Use Tax Permit Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the. Use either the reseller’s permit id number or streamlined sales tax number. The division of sales and use tax manages collection and administration of sales and use taxes for the department of revenue. A sales and. Verify Kentucky Sales And Use Tax Permit.

From www.formsbank.com

Form 51a132 Kentucky Sales And Use Tax Equine Breeders Supplementary Verify Kentucky Sales And Use Tax Permit Holds a valid sales and use tax permit, account no. Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the. How do i obtain a copy of my sales and use tax permit? A sales and use tax permit is contained within. _____, issued pursuant to. Verify Kentucky Sales And Use Tax Permit.

From lonestarliquorlicense.com

Sales And Use Permit Verify Kentucky Sales And Use Tax Permit How do i obtain a copy of my sales and use tax permit? Holds a valid sales and use tax permit, account no. _____, issued pursuant to the sales and use tax law and is engaged in the business of. Use either the reseller’s permit id number or streamlined sales tax number. The division of sales and use tax manages. Verify Kentucky Sales And Use Tax Permit.

From www.golddealer.com

Kentucky State Tax Verify Kentucky Sales And Use Tax Permit Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the. Go to the “verify a permit, license or account” section of the california department of tax and fee. Holds a valid sales and use tax permit, account no. How do i obtain a copy of my. Verify Kentucky Sales And Use Tax Permit.

From www.formsbank.com

Form 51a102e Kentucky Sales And Use Tax Worksheet printable pdf download Verify Kentucky Sales And Use Tax Permit How do i obtain a copy of my sales and use tax permit? Use either the reseller’s permit id number or streamlined sales tax number. Holds a valid sales and use tax permit, account no. _____, issued pursuant to the sales and use tax law and is engaged in the business of. Go to the “verify a permit, license or. Verify Kentucky Sales And Use Tax Permit.

From www.dochub.com

Form ap 201 Fill out & sign online DocHub Verify Kentucky Sales And Use Tax Permit Use either the reseller’s permit id number or streamlined sales tax number. How do i obtain a copy of my sales and use tax permit? _____, issued pursuant to the sales and use tax law and is engaged in the business of. A sales and use tax permit is contained within. Go to the “verify a permit, license or account”. Verify Kentucky Sales And Use Tax Permit.

From www.formsbank.com

Form 10a100 Kentucky Tax Registration Application printable pdf download Verify Kentucky Sales And Use Tax Permit Go to the “verify a permit, license or account” section of the california department of tax and fee. _____, issued pursuant to the sales and use tax law and is engaged in the business of. A sales and use tax permit is contained within. Use either the reseller’s permit id number or streamlined sales tax number. By completing the one. Verify Kentucky Sales And Use Tax Permit.

From www.formsbank.com

Form 51a102e Kentucky Sales And Use Tax Worksheet printable pdf download Verify Kentucky Sales And Use Tax Permit Use either the reseller’s permit id number or streamlined sales tax number. _____, issued pursuant to the sales and use tax law and is engaged in the business of. The division of sales and use tax manages collection and administration of sales and use taxes for the department of revenue. Go to the “verify a permit, license or account” section. Verify Kentucky Sales And Use Tax Permit.

From www.formsbank.com

Form 51a102e Kentucky Sales / Use Tax Worksheet printable pdf download Verify Kentucky Sales And Use Tax Permit Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the. Go to the “verify a permit, license or account” section of the california department of tax and fee. The division of sales and use tax manages collection and administration of sales and use taxes for the. Verify Kentucky Sales And Use Tax Permit.

From www.formsbank.com

Form 51a102 Kentucky Sales And Use Tax Worksheet printable pdf download Verify Kentucky Sales And Use Tax Permit How do i obtain a copy of my sales and use tax permit? A sales and use tax permit is contained within. Use either the reseller’s permit id number or streamlined sales tax number. Go to the “verify a permit, license or account” section of the california department of tax and fee. The division of sales and use tax manages. Verify Kentucky Sales And Use Tax Permit.